It has become so ridiuculous these past Years when the markets just hang in there until the powerless Fed speaks or decide on a 0.25% rate cut like it’s going to change everyhting. NOT! Corporations won’t become more profitable overnight, because of a rate cut. Consumer won’t have more money in their pockets to spend. The markets NEWS (North East West South: to spread your mind in all directions) is just pushing their latest narrative and the Options traders are profiting from it to gap the ask price higher or lower.

The fake medias narrative is just that: a narrative.

The reality is that insiders are selling their shares in mass.

Algos are ready to start selling this week

Rates cut expectations are already build in prices

And the blackout shares buyback is on

And the major employer in Germany (Europe proxy) fires union workers

https://mishtalk.com/economics/volkswagens-choice-fire-union-workers-and-cut-costs-or-go-bankrupt/

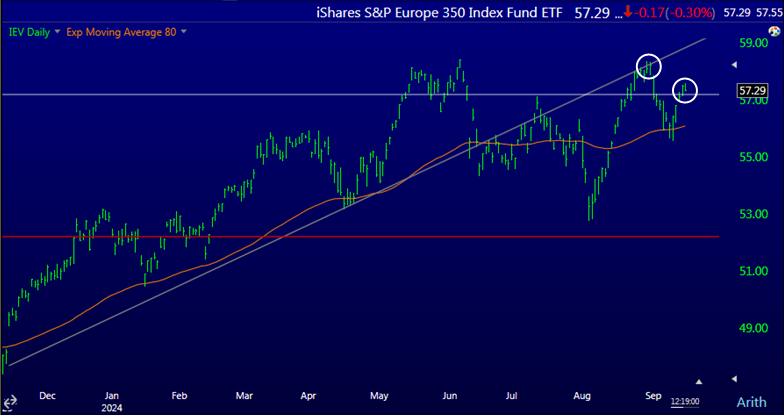

What does the chart says?

It says it failed to go above the 2024 uptrend bottom channel where price was rejected and now it’s shows signs of reversal.

Me not like this!

The next sell of could last much longer as this latest market squeeze is totally fake and built on momo squeeze Call Options.

The bear is showing his nose today. He looks hungry doesn’t he?

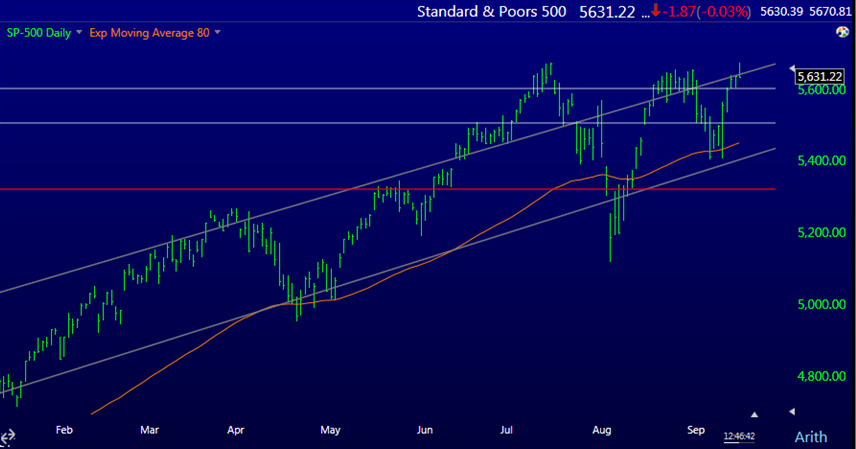

On the US side this is what it looks like. Could they break above the channel from one last hurra of the Fed cutting narrative? Possibly, but it will most probably reverse quickly and go down after.

Don’t be a bag holder. The next major crash could go no bid as most people hold the same ETFs which hold the same major technology stocks, FAANG and Telsers.

Still the same channel drawn in 2023. Price rejecting right on it for now. It woudl also be a tripple top if it reverses.

Oh and by the way the Real Estate bubble is popping: