Just quick update to show how bad things are.

China’s intervention/manipulation create a big squeeze and ramp up to save the day, but this is a desperate move to avoide a crash. It will work only in the short term.

China and Europe are still Economic macro kaputing mode and soon deflation.

US PMI desapointed this week and came out worse than expected at 47.2. Below 50 is considered recession territory. But enought with the Macro!

Deflation means that everything will go down at first, even Gold. Yes I dare say it!

In fact Gold is showing signs of potential reversal that could go much lower than everyone expect since everybody is on the same side of the boat. So the boat will be rocking soon when the trade turns sours.

There is too much complacency right now. Don’t be the bag holder. Bonds will not be the safety net it used to be. It could go up a bit, but it’s a global recession and there is to mcuh debt worldwide.

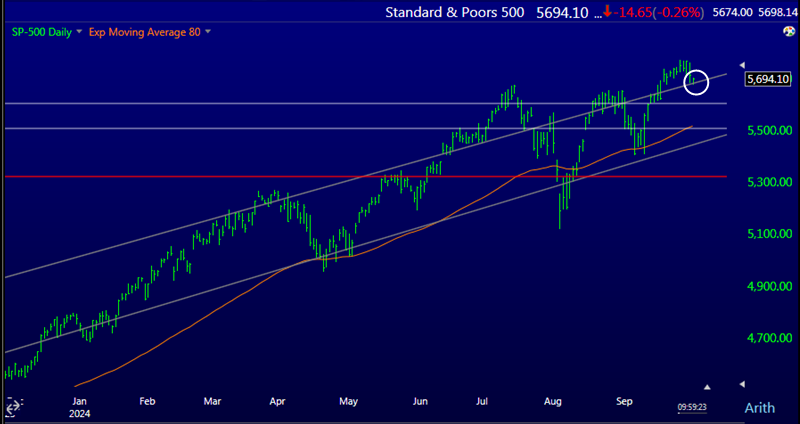

Right now SP500 is attempting to rebound on the channel upper bound.

The next time it goes down, it will go down hard.

Gold broke through the grinding channel recently and is about to reverse unless the middle east war excalates.

On the GLD ETF the mini double top is more obvious.

It should go down around $2500 and if it goes below than it will fall much lower around 2300. Below 2300 it’s a crash.

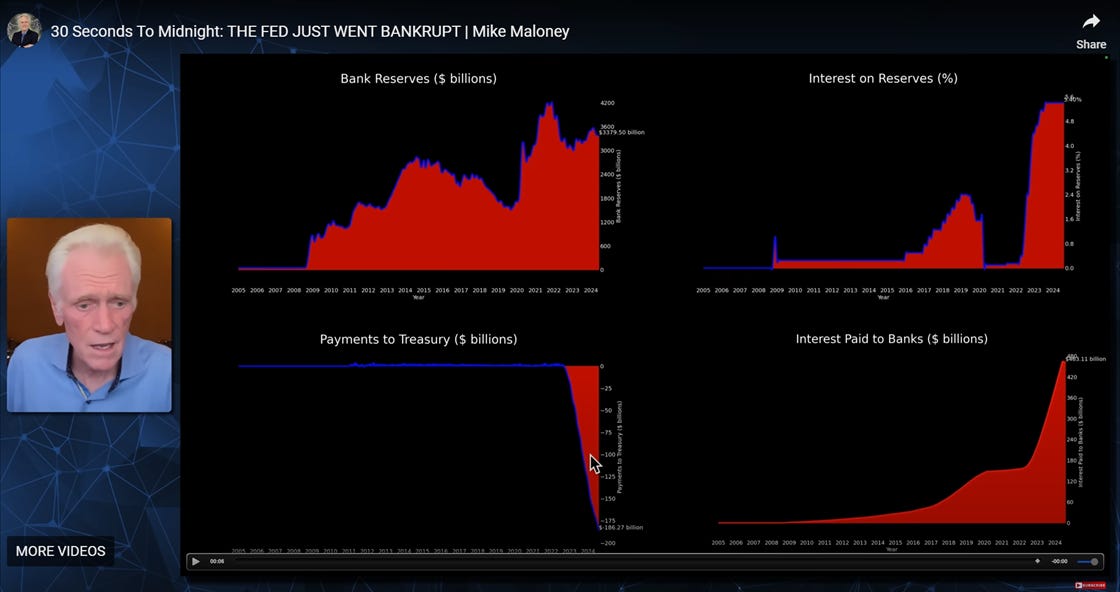

The Fed is bankrupt by the way.