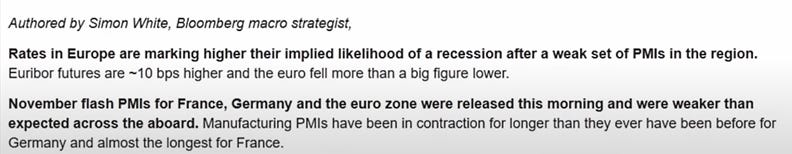

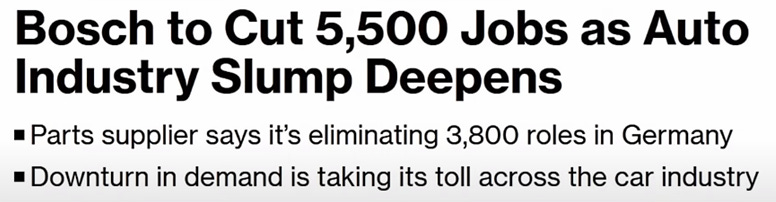

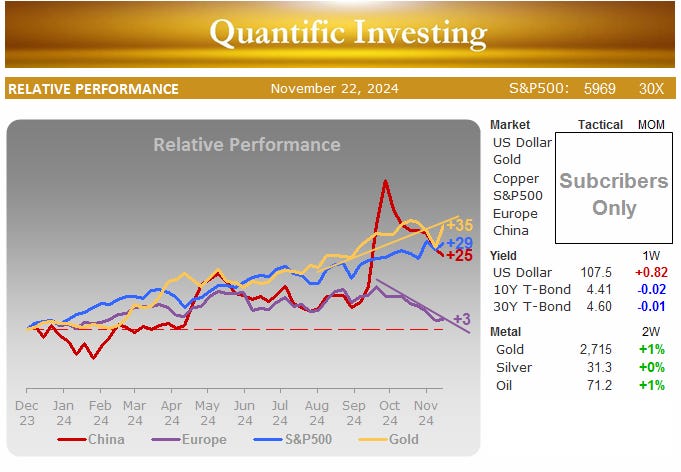

I warned you much earlier looking at the chart that China and Europe were kaputing. Much later, the Maro proof showing up with the latest PMI data and Bosch cutting jobs. And with the US consumer being tapped and Europe economy going down who is going to buy China’s products?

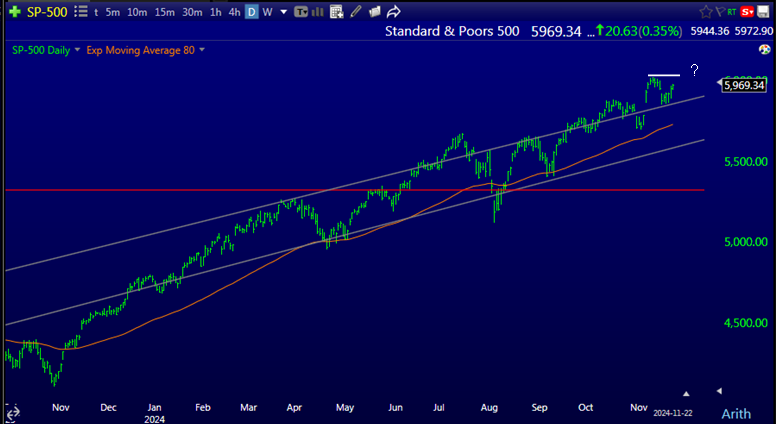

Last week sellers were tricked into a squeeze, but there is no real life or jolly spirit in it. More corporate buy backs and short term Options plays.

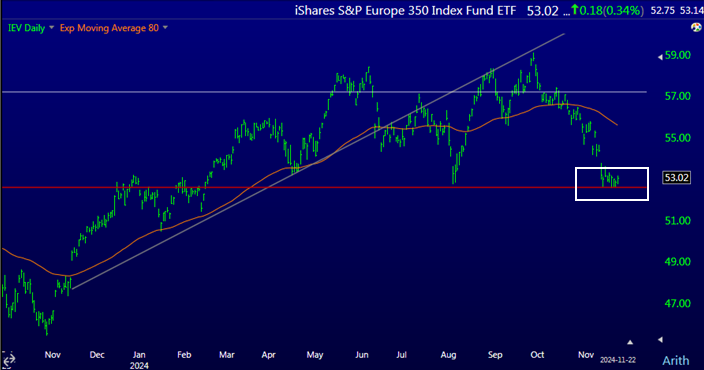

Europe says crash danger as it hovers on the red line.

With the Urkaine war escalation and ususally low trading volume in the December Holiday season. It’s not the time to take risks.

Fortunately with my prorietary the Quantific Investing Report Tactical Indicators take the guessing out the equation for subscribers.

Bond could be due for a rebound, but with so much global debt, kaputing China, kaputing Europe and war mongering, one should be ultra cautious and at best could try tiny sort term trading position if it rebounds. This is not investment advice.

If we look in the past months this chart from the Quantific Investing Report illustrate the recent shift.

The article I posted months ago for subsribers on the 10X opportunites has bear its fruit with some 300% gain so far. And there is more room to go.

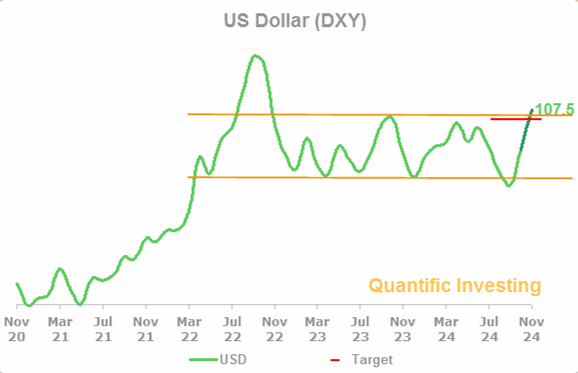

And like the Energizer Bunny the US Dollar keeps going and going, breaking above the long term sideway channel. This recent rebound happen real fast as major insiders are selling their shares. Something could go wrong real fast. This move happened too quickly for my taste.

With all the bad Macro news, a flash crash could be in the cards which would leave retail investor holding the bag.

Be Safe Be Wise.

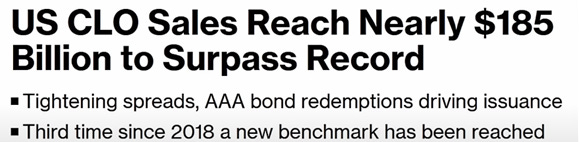

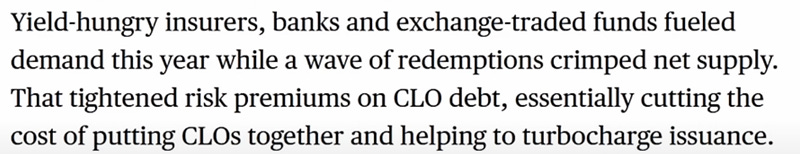

More speculation with highest CLO sales on record.

What can go wrong that?!

Remember 2008?