Protect and Grow your Savings

Forget the 60/40 Portfolio or Buy & Hold, they both get crushed!

The Year 2022 performance proved exactly my point! If you had just bought and hold your portfolio would have have got crused. If you had been invested in a mix of Bonds and Equities you would have lost money as well. SP500 -19%, Nasdaq -33% and Bond -33%.

The Quantific Investing Report Tactical Indicator warns investors when to get out of Bond and Equities and when get back in time to have positive performance!

Tactical Asset Allocation and Swing Trades

I worked as a Quantitative Analyst for 15 Years and I followed the Markets since.

I have researched and developed my own indicators and style.

I take into account some macro forces, but use the Technical indicators I have developped. In the end: Only Price Pays.

All the macro talk and economic indicator are pretty much useless these days.

The up coming years will be more volatile as Markets are overpriced and global sovereing debts becoming extreme.

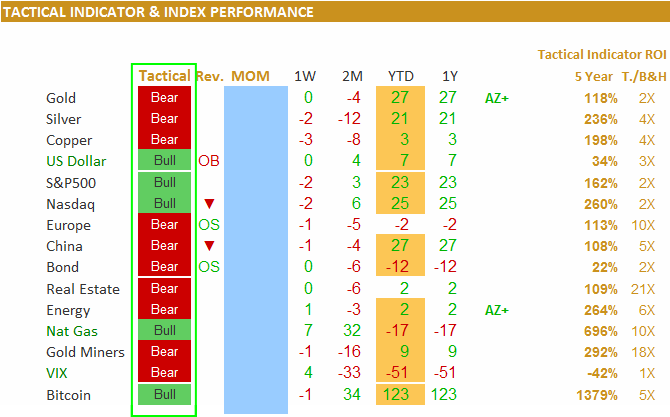

With the Quantific Tactical Indicator you will know when the Markets tracked are favorable or not with a simple BULL or BEAR indicator.

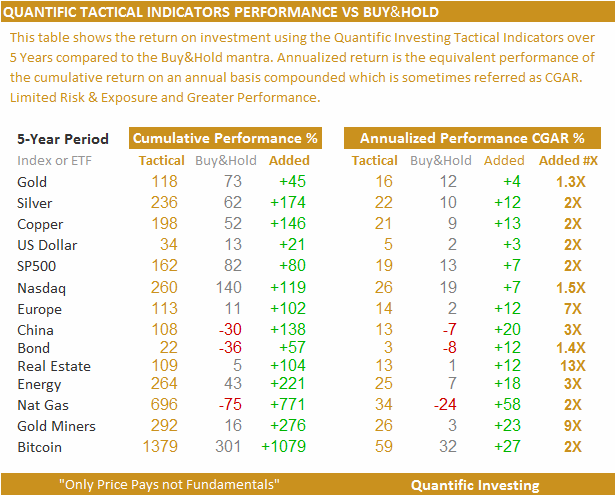

This table shows the historical performance of the Quantific Tactical Indicators over a 5-Year period for each Market Index.

As you can see the Added value over Buy&Hold is always superior!

The added value can be several times superior!

Performance as at December 2024:

The Tactical Allocation Indicators are provided in the Quantific Investing Report under this section including the indicators Performance over the Buy&Hold for the past 5 Years.

You can protect your Portfolio with Tactical rebalance using my indicator or you can invest for Swing Trade!

The Quantific Investing report provides a simplified view of the main asset classes and potential opportunities ahead. You save time and energy as it distills the complicated into a simple synthesized format written in a brief style. Charts and technical indicators help identify bullish/bearish price movements or trends. This way you can assess the situation, identify opportunities and change the Asset Allocation in your Portfolio to grow your savings.

Premium subcribers will get live Trade opportunities or trend changes that you can profit from.

Report has 3 sections:

Relative Performance: Overall brief with relative performance chart and indicators

Tactical Indicator & Markets Preformance: Asset classes performance with technical indicators and up-to-date Tactical Model performance results

Opportunities for Premium Members: Good Risk/Reward investments Swing Trades ideas with charts. This Trades can be short, medium or long term depending on the markets moves.

And unlike most publications I do not write to fill the pages with text and overload clients with pointless narrative and boring analysis.

I keep it Brief and right to the point so you can see what’s going on, assess the situation, make a plan and take action.

Don’t let the Hedge Funds bully your Savings.

Empower yourself and subscribe now!

Premium Subscribers will receive Live Trade emails