Well, they did it again reversed and squeezed back to the top. Totally faked with these wierd 1 day gap up and then nothing, and then 1 day gap up and then nothing. Are you not entertained!

The situation is very risky and dangerous, because it’s a global synchronised recession as both China (Emerging countries proxy) and Germany (Europe proxy) are going down (refer to macro headlines at the end).

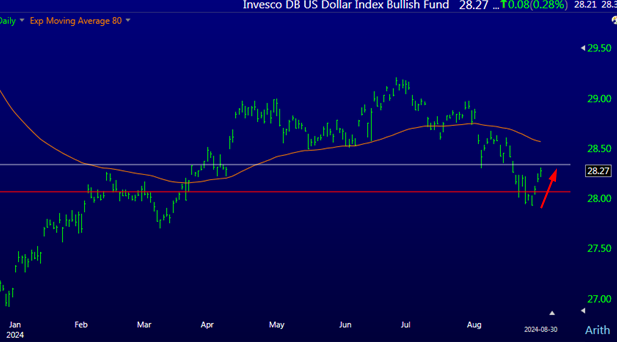

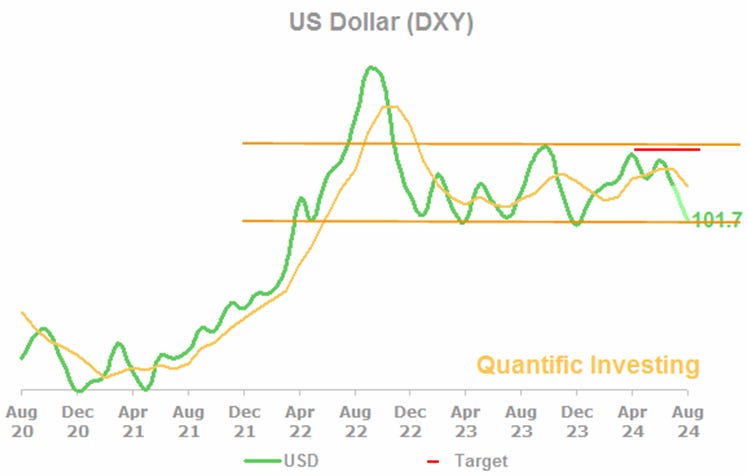

It is especially dangerous now that we have several technical and the macro confluences at important levels with the USD and Yields reversing up.

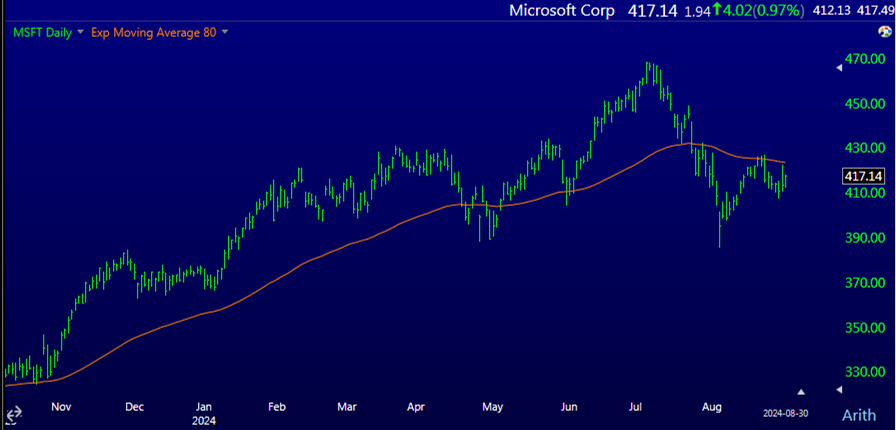

While the AI magical hope bubble is deflating with NVidia recent earnings being good, but forward guidance bad. And microsofty cannot even push above its moving average.

But is you do not want to spend time studying and analysing all these and try to figure out all this mess, just subscribe to the Quantific Investing Letter with ist Tactical Asset Allocator for the most important markets including Bitcoin.

https://quantific.substack.com/about

SP500 Double Top formation near top line channel.

US Dollar rebounding at LT channel bottom

LT channel

Yields fussed aroung the bottom channel for a while, but are back in and reversing, which mean Bonds are going down.

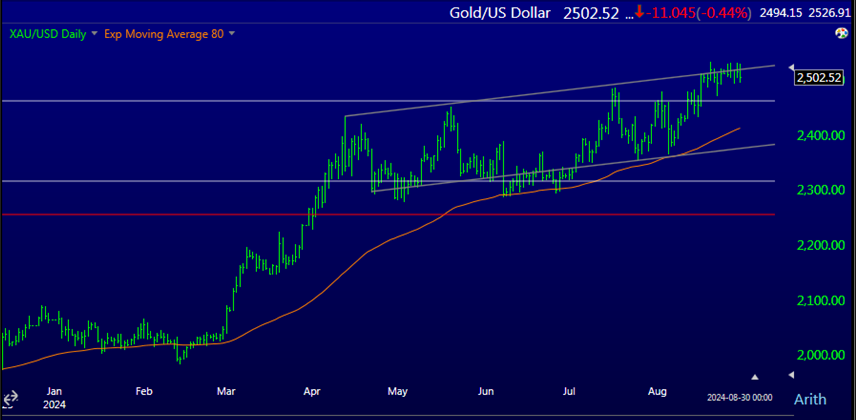

Too many retailers are bullish on Gold. Gold has been in a grinding upward channel for while, but it feels like a bull trap. Significant distribution signs near this brave new high. If Gold goes below the lower channel then the market will most probably crash.

The next bottom in gold will be the best and safest entry point for LT investors.

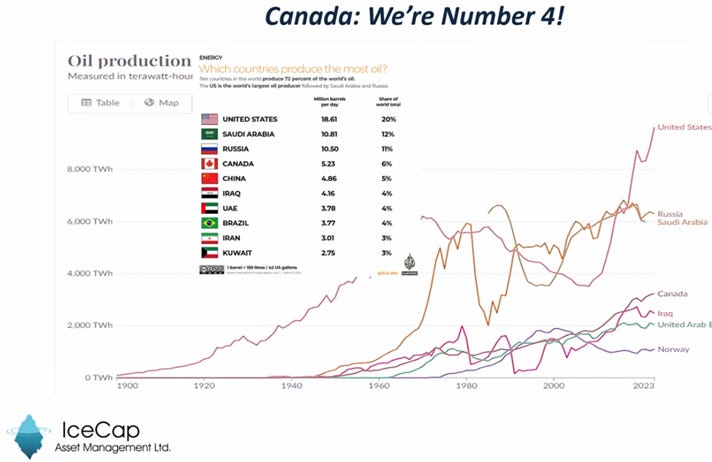

Did you know that Canada is the 4th largest Oil producer?

China is crisis mode desperately attempting to avoid a Real Estate crash.

Europe is also in bad shape. Below 50 is considered recession territory.