The correction finally happen, but there is not real panic. Overextended Tech. went down further than the SP500. NASDAQ is now sitting at an important level which is also at the 80EMA.

It’s oversold ST and rebound is likely. The position of the next peak will critical.

SP500 is back in the Long Term 2023 channel. Can it go to 5300? Possibly.

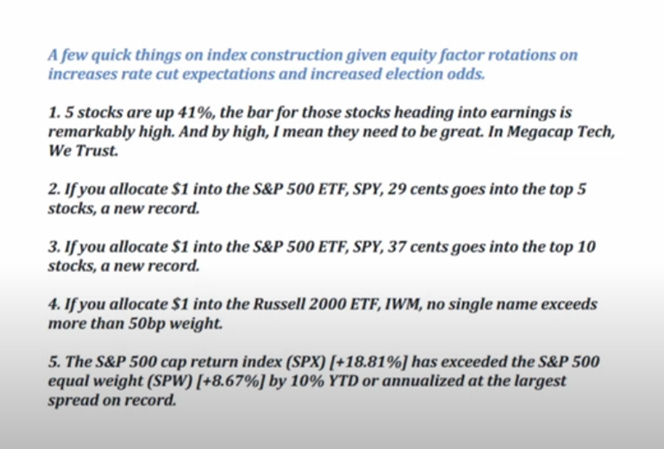

This year’s run was mostly based on Fed Rate cut expectation and Call Options bubble FOMO.

The problem is that Call Options sellers to limit their risk by buying the underlying stocks of the Option they sold to investors. So if they buy stocks, and investor exercises their Calls and the corporations buy back their own stocks then they can make it run like this for a long while like they have done so far this year.

So if the Fed decide the cut rates in September then it could create a FOMO rush in anticipation of more rate cuts later this year.

It could correct a bit more in August, but then the CTAs and Hedge Fund will want to front run the move and they could start add Long positions.

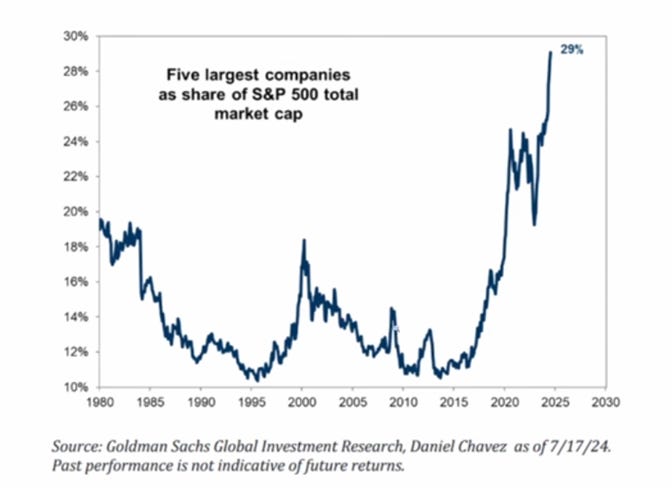

5 companies represent 30% of the SP500 index. It’s really easy for them to move it up by playing just on a few stocks and doing sector rotation here and there.

But at some point the musical chair will stops and good luck for the bag holders has to concentraction in a few stocks in the indexes and the indexes ETF has potential for a crash without buying bid. In lame terms everybody is on the same side of the boat holding these few stocks so when everybdoy rush to sell, who si gong to buy them?..

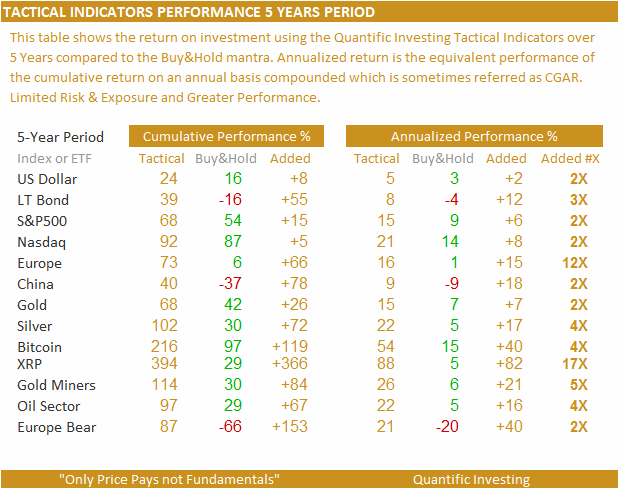

That is why one must have a rational system like the Quantific Tactical Asset Allocator that consistently outperform the index.