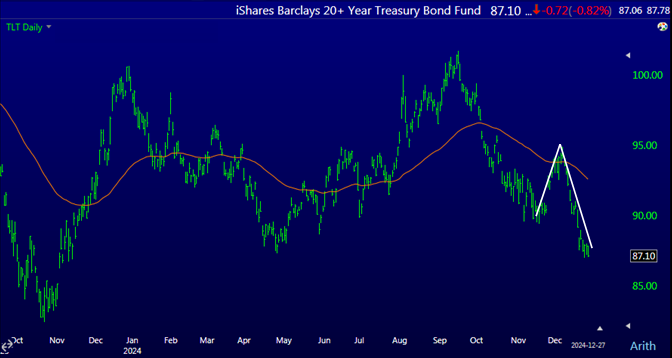

In the previous article I said that things were not so good under the hood and just a 3 days later Markets tanked hard and fast. Bond managed to hold, but have been plunging since; This is a bad sign in itself.

I expected the rebound, but thought it would go higher. As of this Fridray Market indexes reverved south.

These Markets were propped up on Options bubble fumes and Corportate Buybacks with a mix of sectors rotation trickery.

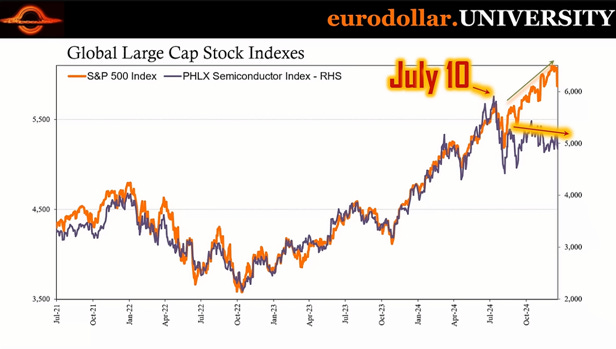

Did you say speculation? Yep! Just watch the semis divergence!

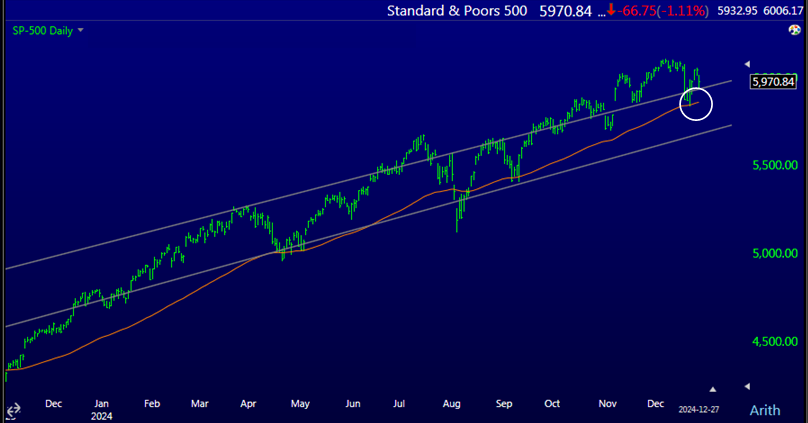

This is the same channel drawn in 2023.

So it broke down the upper channel then rebounded a bit.

If it breaks below the 5890 level then it will be an air pocket to the 5500 area or lower.

Next week will be interesting and could be the start of a larger drop below the channel which would trigger a significant sell off that could accelerate in 2025.

The recent drop was just a shot accross the bow.

Bond look terrible. It could stabilize soon for a potential short term rebound trade.

For those who still believe in the 60/40 Portolfio fairy tale. Check the 2022 Peformance for the main asset classes!

2025 will be a rocky Year Markets wise and those who stick with the Buy&Hold mantra will have their savings crushed. Conisder yourself warned.

With the Quantific Investing Report and its Tactical Indicator there is no guess work. You know the Markets are behaving well or badly.

Model portfolios don’t work, fundamentals don’t work and long wordy analysis are just good to fill pages.

Only Price Pays! And with the Quantific Tactical Indicator, you know what the prices are doing when it’s a good time to jump in or jump out.